By Francesc Borrull · April 7, 2025

Note to the Reader:

This document is the second installment in my series. If you haven’t read Part I yet (found here), I highly recommend reviewing it first for full context. Part II builds upon the foundations laid earlier, diving deeper into key insights and developments.

III. Distribution of Wealth: Who Gets What and Why?

Creating wealth is one thing—distributing it is another. Who gets what, and why? This question is at the heart of economic systems, political debates, and moral discussions. Some argue that markets distribute wealth fairly based on effort and innovation, while others claim that structural factors create imbalances that need correction.

Let’s explore how different forces shape wealth distribution.

1. Capitalism and Market Forces: How Free Markets Allocate Resources

In free-market economies, wealth is primarily distributed through competition, supply and demand, and voluntary transactions. The idea is simple: those who create value are rewarded with wealth, whether through entrepreneurship, investment, or labor.

- The Invisible Hand at Work

Adam Smith described how self-interest, when guided by competition, leads to efficient outcomes without central planning. In a functioning market, a business that produces high-quality products at a fair price succeeds, while inefficient businesses fail. This natural selection of the economy encourages productivity, benefiting society as a whole. - The Alternative?

History has shown that when governments attempt to centrally control wealth distribution, the results are… well, let’s just say some ideas sound better in theory than in practice (as anyone who’s ever waited in a breadline could tell you).

2. The Role of Governments: Taxes, Social Programs, and Redistribution Policies

Governments influence wealth distribution through taxation, social programs, and regulation. The level of intervention varies across countries, with some emphasizing free-market policies (the U.S.) and others opting for stronger welfare systems (much of Europe).

- Taxes and Redistribution

Governments tax income, capital gains, and corporate profits to fund infrastructure, education, and social services. The idea is to balance opportunity with social stability, but the degree of taxation is a constant debate.- Low taxes encourage investment and entrepreneurship but can limit public services.

- High taxes fund social programs but may reduce incentives to work and invest.

- The Safety Net Dilemma

Social programs like unemployment benefits, healthcare, and pensions help those in need, but there’s an economic trade-off.- In the U.S., benefits tend to be lower, emphasizing individual responsibility and workforce participation.

- In Europe, benefits are generally more generous, reflecting a belief in collective social stability.

- The challenge? Striking a balance—a safety net should catch people when they fall, not become a hammock that discourages productivity.

- Laissez-Faire vs. Regulation

Some economists argue that the government should stay out of the way, letting markets self-correct (laissez-faire). Others believe that unchecked capitalism leads to monopolies and exploitation. The debate continues: How much is too much regulation? And how little is too little?

3. Economic Inequality: Inevitable or Problematic?

Wealth inequality exists in all societies. The real question is: when is it a natural result of incentives, and when is it harmful?

- Inequality as a Driver of Progress

Some inequality is necessary—it rewards hard work, risk-taking, and innovation. Those who create, invest, or work harder tend to accumulate more. This is not unfair—it’s how incentives work. Many successful individuals started with nothing and built their wealth through effort, discipline, and smart decisions. - The Problem of Extreme Inequality

However, when inequality becomes too extreme, it can slow economic growth, reduce social mobility, and create instability. If wealth is concentrated in too few hands, opportunity shrinks for everyone else. - The Moral and Behavioral Challenge

Not everyone struggles due to external forces—some people exploit the system, whether at the top (corporate bailouts, tax loopholes) or at the bottom (welfare fraud, dependency). This raises ethical questions:- Should hard-working individuals subsidize those who make poor choices?

- At what point does helping people become enabling dependency?

- How do we ensure fairness while maintaining incentives?

No Easy Answers

Wealth distribution is not just about economics—it’s a political, social, and ethical debate. Markets create efficiency, but fairness is subjective. Governments provide stability, but too much intervention can stifle growth. Inequality can drive ambition or erode opportunity.

The challenge is finding the right balance—which brings us to our next section: the debates and challenges of wealth distribution in the modern world.

IV. Challenges and Debates in Wealth Distribution

As we move forward, the debate over how wealth should be distributed is becoming even more complex. Economic systems evolve, societies shift, and new challenges emerge—some of them more disruptive than anything we’ve seen before.

In this section, we’ll explore key debates surrounding wealth distribution: the balance between markets and government, global inequalities, and the impact of technological revolutions like AI.

1. The Balance Between Free Markets and Government Intervention

The age-old debate continues: Should economies lean toward free-market capitalism or government intervention? The right balance depends on the country, the industry, and the specific economic challenge at hand.

Example 1: The U.S. Model – A Market-Driven Economy

In general, the United States favors free markets, allowing businesses to compete with minimal government interference. This approach encourages:

- Innovation and entrepreneurship, as seen in Silicon Valley.

- A flexible labor market, where businesses hire and fire based on demand.

- Lower taxes on businesses and individuals, creating more incentive to invest and expand.

However, critics argue that a hands-off approach can widen inequality and leave vulnerable populations behind. The debate over healthcare is a clear example—while the U.S. relies largely on private insurance, many other developed nations offer government-run healthcare.

Example 2: The European Model – More Government Intervention

Many European countries, particularly Scandinavia, Germany, and France, take a more interventionist approach, emphasizing:

- Stronger social safety nets, including universal healthcare and higher unemployment benefits.

- Higher taxes on corporations and the wealthy to fund public programs.

- Labor protections, such as stricter rules on layoffs and worker benefits.

This model reduces economic volatility and provides a sense of security—but it also comes with trade-offs, such as higher costs for businesses and lower economic dynamism compared to the U.S.

So, which approach is better? It depends on what you value most: growth and opportunity, or stability and equity.

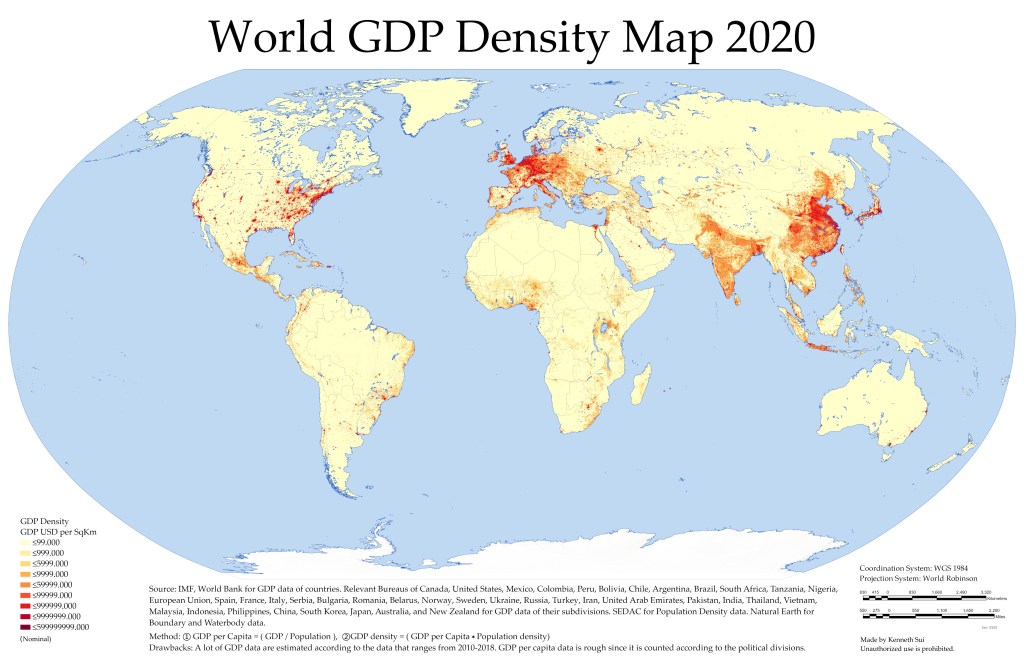

2. Global Wealth Distribution and Its Implications

One of the biggest economic puzzles is: Why are some countries rich while others remain poor? While each case is unique, some common factors shape global wealth distribution.

- Natural Resources: Some nations, like Norway or Saudi Arabia, are wealthy due to abundant natural resources, while others lack them.

- Institutions and Governance: Nations with strong legal systems, property rights, and low corruption tend to prosper.

- Education and Infrastructure: Wealthier countries invest in human capital and innovation, while poorer nations often struggle due to lack of investment and unstable political systems.

This imbalance has major implications:

- Migration pressure: Wealth gaps lead to increased migration from poorer to richer nations.

- Global trade tensions: Disparities create tensions over trade policies, labor exploitation, and economic dependence.

- Foreign aid vs. self-sufficiency: Does helping poorer countries solve their problems or create dependency?

Global wealth is not static, and nations can rise or fall based on policies, governance, and external factors. South Korea and Singapore provide examples of how strong governance and market-driven policies transformed struggling economies into global powerhouses.

3. The Future: Automation, AI, and the New Economy

If there is one force set to reshape wealth distribution like never before, it is Artificial Intelligence (AI). This is not just another technological advancement—it is a paradigm shift that will redefine labor, capital, and opportunity.

AI: The Most Transformational Shift in Modern History

Unlike previous technological revolutions, which replaced manual labor, AI threatens to replace cognitive labor, potentially displacing millions of jobs at every level:

- Manufacturing: Robots and AI-driven automation continue to replace factory workers.

- White-collar jobs: AI is now writing reports, analyzing data, and even replacing entry-level finance, legal, and customer service positions.

- Creative industries: With AI-generated music, art, and even writing, human creativity is no longer untouchable.

Who Wins and Who Loses?

The AI revolution will likely increase wealth inequality unless carefully managed:

- Those who own AI and automation technology (tech giants, investors) will amass enormous wealth.

- Highly skilled workers in AI-related fields will benefit enormously.

- Many traditional workers—both blue- and white-collar—may see their jobs disappear.

The Economic Questions AI Raises

- Should AI-driven industries be taxed more heavily?

- How do we retrain displaced workers?

- Is Universal Basic Income (UBI) a solution, or does it create dependency?

The AI-driven economy could create unprecedented prosperity—but if handled poorly, it could also exacerbate economic divides like never before.

Looking Ahead

As we stand at the crossroads of technological, economic, and social transformation, one thing is clear: the debate over wealth distribution is far from over. The balance between markets and governments, global wealth shifts, and the impact of AI will define the future of economic opportunity.

This sets the stage for our final section—the conclusion, where we tie everything together and explore the fundamental question: What kind of economic future do we want to create?

Conclusion: Why This Matters to Me

Understanding economics is not just about abstract concepts or theoretical debates—it is essential for making informed decisions that shape our lives. For me, economics is not merely an intellectual pursuit; it’s a tool for social mobility and building stronger, more vibrant communities. I’ve always believed that education is the key to unlocking economic opportunities, and it is through education that individuals gain the skills and knowledge to navigate and thrive in an ever-changing economy. The ability to access, understand, and apply economic principles can transform lives—whether through better job opportunities, entrepreneurial ventures, or the ability to influence the world around us.

We are living in an era where the job market is evolving rapidly. Half of the positions available 20 to 30 years from now have yet to be created. This makes economic literacy even more vital. Without an understanding of how wealth is created and distributed, individuals may find themselves left behind as the world moves forward. We must embrace adaptability and continuous learning, as these are the foundations of future success.

But it’s not just about the future of work—it’s about the present and how we engage with economic ideas today. In a world where news is often filtered through the lens of soundbites and political populism, it is more important than ever to look beyond headlines and think critically. Too often, we hear voices—whether online “influencers” or talking heads—spouting off opinions without any credible expertise or deep understanding of the issues at hand. We need to be aware of this, and not accept opinions without scrutiny. Question the sources, demand clarity, and challenge simplistic narratives. Engaging with economic ideas requires a critical mind, and it is through this approach that we can truly understand the complex world in which we live.

Ultimately, this is why I write—because I want to understand how the world works and how we can shape it for the better. My journey of understanding economics is ongoing, and I invite you to join me in this pursuit.

So, here’s the question for you: How do you see wealth creation and distribution in your own life? Is it something that comes through personal effort, opportunity, or perhaps luck? How can we each contribute to a more equitable future while understanding the forces at play? These are questions worth pondering.

© Francesc Borrull, 2025